Robin MacLennan

Ontario Construction Report staff writer

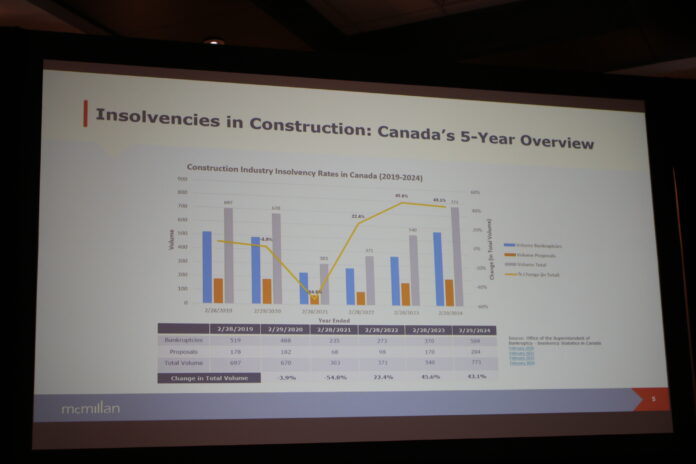

In recent years, the construction industry in Canada has been facing a growing crisis: insolvencies. According to recent studies, the number of insolvencies in Canada’s construction sector reached a staggering 569 for the fiscal year ending Feb. 29, 2024. This marks a significant increase from 370 in 2023, 273 in 2022, 235 in 2021, 488 in 2020, and 519 in 2019.

Gemma Healy-Murphy, a litigation and dispute resolution lawyer with particular expertise in leasing, construction and product liability disputes at McMillan LLP spoke at the OGCA Construction Symposium on April 11 and 12. She shared the concerns she hears from contractors about the rapid escalation of insolvencies, noting that this trend is not unique to Canada.

“The volume of bankruptcies really has increased dramatically over the last five years, and most dramatically since 2022,” she said. “In 2024 the number jumped 43.1 per cent to 773 … and the story doesn’t get better.

“It’s not isolated to Canada. Globally, construction is facing the same challenges we are facing here.”

Bankruptcies jumped this year by 35 per cent in Sweden, 38.7 per cent in the Netherlands, 36.3 per cent in Japan, and 35 per cent in France. Australia, the United Kingdom, and the United States also were hit with double-digit percentage increases in construction company bankruptcies, although lower.

Speakers highlighted factors contributing to this alarming trend.

Canadian inflation rates have surged, exacerbating the already strained financial conditions of construction firms. Labor shortages, coupled with high-interest rates, are compounding the industry’s woes. Moreover, rising material costs and supply chain disruptions are further burdening construction companies financially.

The well-attended session “Top Legal Challenges Faced by Contractors, 2024 Edition” focused on the relentless pace of change in construction and challenges from a legal perspective, including owner procurement practices, contract risk allocation and the opportunities and threats posed by emerging collaborative project delivery models.

Speakers stressed the importance of proactive measures in response to these challenges. Despite the absence of a “magic wand” solution, they urged construction companies to prepare diligently for potential financial setbacks.

The construction sector’s troubles are not isolated, as insolvencies in accommodation and food services also saw a substantial increase of 43.8% between 2023 and 2024. Legal experts at the symposium highlighted the top legal challenges facing contractors in 2024, including contract risk allocation and compliance with contract notice requirements.

As owners deal with rising costs and economic uncertainty, the top legal challenges facing contractors in 2024 are:

- Insolvencies

- Push for “cost certainty”

- Contract risk allocation

- Contract notice requirements

- Effective use of adjudication

“Pay attention to these things if you are giving a price today because what are things going to look like in the future,” Healy-Murphy said. “This is very challenging and it will continue to be challenging.”

In addition, the panel pointed to a Supreme Court decision issued last November that broadens liabilities under the Ontario Occupational Health and Safety Act, holding owners accountable even if their role is limited to occasional quality assurance inspections.

The decision could result in unnecessary legal proceedings and compel owners to adopt due diligence defenses, even when they have no direct control over construction sites.

“Be prepared up front because, unfortunately, we see things happen. It’s an unfortunate reality and should be something to think about in today’s market,” Healey-Murphy advised.