InterRent Real Estate Investment Trust (IREIT), Trinity Developments and PBC Real Estate Advisors Inc. has announced plans for what IREIT describes as a “transformational development at the heart of Ottawa’s LRT system.”

The investment trust says it has purchased a one-third share of the approximately 3.6 acre Trinity Station site at 900 Albert St. for $14.2 million (including pre-development and closing costs) in the joint venture. (The overall purchase value of the land was not specified in the IRIT news release; if the partners had paid equally for their shares, it would be $42.6 million.)

The partnership says it has selected Toronto-based B+H Architects and GGLO Design (GGLO), a Seattle-based architect which has been at the forefront of tech-orientated markets, “for their combined international design experience and proven track records of creating dynamic and immersive community focused spaces.”

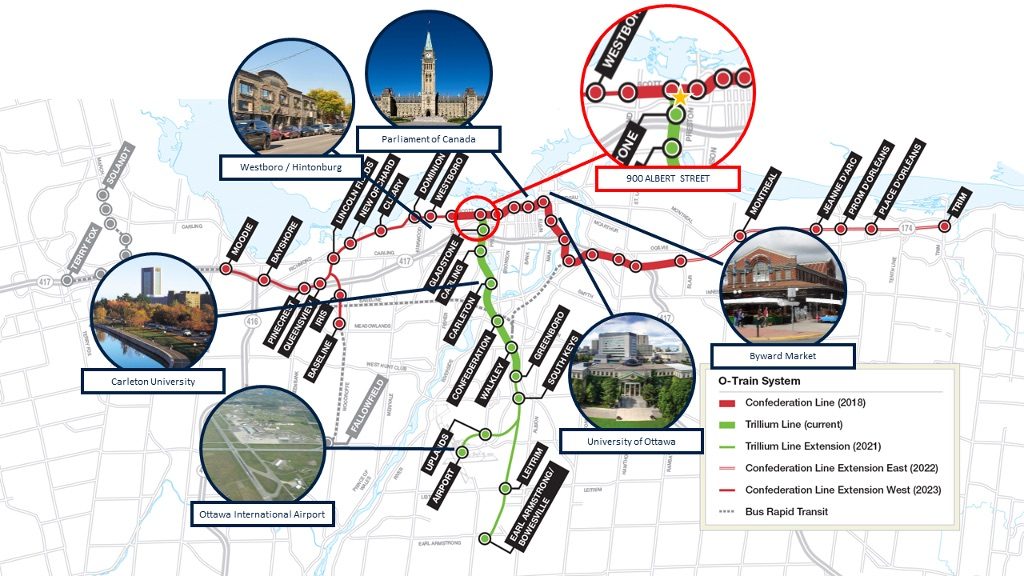

IREIT says the new development will be one of the first true multi-use developments in the country on a mass transit line. The site is approved for up to three towers with the initial concept design to potentially include 1,000 multi-family residential suites, retail and office space at the link between the Trillium Line (the North/South line) and the Confederation Line (the East/West line) of the LRT.

IREIT says the new development will be one of the first true multi-use developments in the country on a mass transit line. The site is approved for up to three towers with the initial concept design to potentially include 1,000 multi-family residential suites, retail and office space at the link between the Trillium Line (the North/South line) and the Confederation Line (the East/West line) of the LRT.

Trinity Developments, which has been a major developer across Canada for the last 25 years, was one of the key developers and owners of the new Lansdowne Urban Development in downtown Ottawa, and, was part of the winning bid team RendezVous Lebreton for the redevelopment of the Lebreton Flats.

PBC Real Estate Advisors Inc. (PBC), as asset manager for PBC 900 Albert Street Limited Partnership, holds the development’s third share. A news release says PBC seeks to pursue, develop, acquire, fund and manage various real estate assets including land, real property and mortgages on behalf of its institutional limited partners throughout Canada.

“We believe the combination of these entities and the premium location shall ensure long term success and more importantly a steady stream of cash flow for our valued shareholders,” said IREIT CEO Mike McGahan.

“Locations like this do not come around every day and we felt that we needed to participate and have a hand in shaping the new wave of multi family development,” he said.